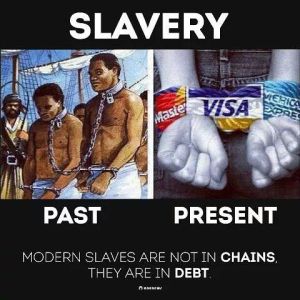

Slavery

Slavery, we think, is a relic of the past. Yet, for millions caught in the relentless cycle of credit card debt, freedom is merely an illusion. The chains may be invisible, but the sense of entrapment is just as real.

The Bankers Call of Easy Money

Digital payments have given us the perception of limitless spending power. A quick tap with a debit card directly accesses our bank accounts, a stark reminder of our financial constraints. Credit cards, however, provide a deceptive buffer. Fraudulent charges? The bank will handle it (for now). Impulse purchases seem affordable, the true cost hidden until the end of the month.

The Monthly Boomerang

That monthly credit card statement arrives like a boomerang, turning the fleeting satisfaction of instant gratification into a wave of dread. Interest rates, those hidden predators, have transformed a $50 dress or a night out into a growing burden. With each passing month, the debt multiplies, fueled by desperation and the insidious temptation of minimum payments.

From Chains to Debt Serfdom

No longer bound by physical shackles, the modern-day slave is chained to their cubicles with interest charges and mounting balances. They toil endlessly, yet their paycheck offers no true ownership of their earnings. A significant portion belongs to the credit card company, a constant reminder of their financial bondage. The stress consumes them – relationships fray, and their health deteriorates under the weight of a self-inflicted burden.

Freedom Isn't Free (But It Shouldn't Cost This Much)

It's important to remember that credit cards can be used responsibly. Many individuals leverage rewards and cashback programs, enjoying the convenience without incurring debt. For those who fall into the trap, however, it is the reckless spending—not the cards themselves—that holds them captive.

Breaking the Chains

Escape is possible, though it requires discipline and often outside help. Strict budgeting, destroying cards, and seeking professional debt counseling may be necessary. Yet, the most important shift is psychological. Credit cards must be seen not as free money to be spent, but as a tool to be used with utmost caution.

[Placeholder: Image of a person cutting up a credit card, or similar symbolic image]

The forms of slavery evolve with the times. Just because the chains now come with a points program and a shiny logo doesn't mean the loss of financial freedom is any less devastating.

Let me know if there's a certain direction you'd like to expand upon, or if you want to tweak the tone to be more provocative or more practical.