Credit Card

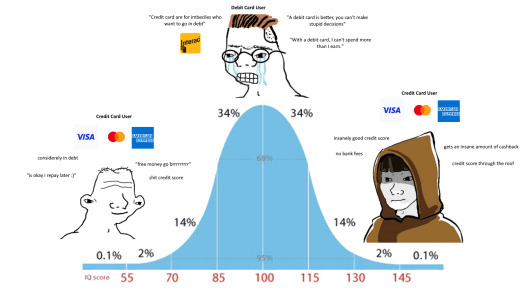

Credit cards are a form of rotating credit that allow users to borrow money on a recurring basis, but using them responsibly requires individuals to manage their spending and pay off their balances on time.

Credit Scoring

Credit Score Game: Where Solvency Equals Servitude, and Debt is Your BFF

Ah, the enigmatic credit score. That three-digit beast that holds the keys to your financial kingdom... or shackles you to a lifetime of plastic fantastical servitude. It's a system so ludicrous, so Kafkaesque, that one can only laugh through the tears (while simultaneously checking credit karma every five minutes).

Let's face it, folks, the credit score is less about measuring your financial responsibility and more about predicting your future impulse-buying sprees. They love you when you're in debt, drowning in a sea of lattes and avocado toast financed by plastic fantastic. Why? Because, my dear friends, a little financial desperation makes you a prime target for their next round of predatory interest rates.

Think of it as a twisted game of financial chicken. Each swipe of your card is a dare: "How much financial ruin can you handle before you buckle?" And the banks, those benevolent overlords, are cheering you on from the sidelines, tallying up your score like a twisted Monopoly game.

The irony, the sheer audacity of it all! Pay off your balance in full, like a responsible adult? Score goes down! Why? Because, clearly, responsible adults are boring. They don't keep the debt hamster wheel spinning. They don't cough up that juicy, year-after-year slice of interest that fuels the mansion-building dreams of some overpaid executive.

Oh, and speaking of dreams, let's talk about that 7.25% 30-year fixed mortgage. The golden apple of the credit score game. The ultimate symbol of "success" in this debt-fueled dystopia. You get to trap yourself in a McMansion, shackled to a job you hate, just to prove you're a responsible cog in the machine. All for the glorious privilege of paying a bank more than twice the actual value of your house!

But hey, at least you'll have a nice white picket fence and a fancy car to park in your driveway. You'll be officially "living the dream," even if that dream involves waking up at 5 am to answer emails in your cubicle prison. You'll be a hamster with a good credit score, and isn't that what life is all about?

So, the next time you check your credit score and find it mysteriously plummeting, take a deep breath and laugh. Laugh at the absurdity of it all, at the system that rewards debt and punishes responsibility. And then, with a twinkle in your eye, go find a new, more sustainable way to build your life. Because, friends, there's a whole world out there beyond the plastic palace walls, and it doesn't require a 7.25% mortgage to enter. Trust me, the avocado toast tastes just as good on the other side.

Remember, the credit score game is rigged. Don't be a pawn. Be a rebel. Break free from the matrix. And most importantly, never forget: debt is not your friend, it's your chains. And a good credit score isn't a badge of honor, it's a participation trophy in the hamster wheel race. Choose freedom, my friends. Choose laughter. Choose life... without the interest rates.

Minimum Payment

Credit card companies require a minimum payment each month to keep your account current. This minimum payment is usually a small percentage of your total balance, typically around 2-3%, and it may seem like an easy way to keep your account in good standing without paying too much. However, paying only the minimum can be a costly mistake in the long run.

First, paying only the minimum means that you will be paying interest on the remaining balance, which can add up quickly. If you have a balance of $1,000 and an interest rate of 18%, and only make the minimum payment each month, it will take you over five years to pay off the balance, and you will end up paying over $500 in interest charges. This is a significant amount of money that could be better used elsewhere.

Second, paying only the minimum can negatively impact your credit score. One of the factors that affects your credit score is your credit utilization ratio, which is the percentage of your available credit that you are using. By only paying the minimum, you are keeping a high balance on your card, which can increase your credit utilization ratio and lower your credit score.

Finally, paying more than the minimum can help you get out of debt faster and save you money in interest charges. By paying more than the minimum, you are reducing the balance on your card and paying less interest over time. This will help you become debt-free sooner and give you more financial freedom in the long run.

In conclusion, paying only the minimum on your credit card may seem like an easy way to keep your account current, but it can be a costly mistake in the long run. By paying more than the minimum, you can save money on interest charges, improve your credit score, and become debt-free faster. So, if you have the means to pay more than the minimum, it is always a good idea to do so.

Satire Article

Credit Cards: The Most Wonderful Tool for Ruining Your Life!

Credit cards are the ultimate solution to all your financial problems. They offer a quick and easy way to buy anything you want, even if you can't afford it. With credit cards, you can easily rack up huge amounts of debt, leading to financial ruin and bankruptcy. But who needs savings anyway? Live for today and let tomorrow take care of itself!

If you want to max out your credit card, here are some helpful tips:

- Buy things you don't need: why settle for necessities when you can have luxury? A new designer handbag or the latest iPhone are always worth the debt.

- Ignore your budget: who needs a budget when you have a credit card? You don't need to know how much money you have - just buy whatever you want and deal with the consequences later.

- Pay only the minimum balance: don't worry about paying off your balance in full each month. Just pay the minimum amount and enjoy the high interest charges that come with it.

- Apply for more cards: more cards mean more spending power, and more debt. It's a win-win situation!

- Use credit cards for cash advances: need cash? Just use your credit card! But remember to pay it back with interest, or your debt will skyrocket.

Now that you know how to max out your credit card, it's time to sit back and relax while the debt piles up. After all, it's not your problem until it becomes one.

As a Hard Drug

Credit card addiction and spending addiction can be likened to the effects of hard drugs on the brain. Just like drugs can release dopamine in the brain, creating a pleasurable sensation, using credit cards and making impulsive purchases can create a similar sensation of excitement and pleasure.

Over time, this can lead to a dangerous cycle of addiction, with individuals seeking out more and more credit or making more and more purchases in order to achieve the same pleasurable sensations. This can lead to overspending, mounting debt, and financial ruin.

Like drugs, credit cards and spending can also create a sense of euphoria and escape from reality. For some individuals, the act of spending may provide a temporary distraction from problems in their personal lives or feelings of anxiety and depression.

However, just as drugs can have harmful physical and psychological effects, credit card addiction and spending addiction can have similarly damaging consequences. These can include financial hardship, strained relationships, and even legal issues.

Ultimately, just like with drug addiction, breaking the cycle of credit card addiction and spending addiction requires a combination of self-awareness, discipline, and support from loved ones and professionals. It's important to recognize the signs of addiction and seek help before the consequences become too severe.

Credit Tips

My mom is on the left, Me in Thailand is in the Middle, Prof.Starling on the Right. How to Use Your Credit Responsibly

In reality, credit cards are a powerful financial tool that can help you manage your finances and build a good credit score, as long as you use them responsibly. Here are some tips for using your credit responsibly:

- Stick to your budget: make sure you only spend what you can afford, and don't use your credit card to buy things you don't need.

- Pay off your balance in full each month: avoid high interest charges by paying off your balance in full each month.

- Avoid cash advances: cash advances come with high interest rates and fees, so avoid them whenever possible.

- Don't apply for too many cards: too many cards can lead to overspending and debt, so stick to one or two cards that meet your needs.

- Monitor your credit score: check your credit score regularly and dispute any errors or inaccuracies.

By using your credit card responsibly, you can enjoy the benefits of having a good credit score and financial security, without the stress and anxiety of unmanageable debt.

Thailand difficulty of access to Credits

The American credit system has long been a hallmark of the nation's consumer culture, with easy access to credit cards and loans becoming a rite of passage for many young adults. With the advent of rotating credit, Americans are now able to indulge in their desires without having to worry about the immediate cost. The system works like a revolving door, allowing consumers to borrow and repay in a continuous cycle.

On the other hand, In Thailand, many people face difficulty of access to credit due to strict regulations and requirements imposed by banks and financial institutions. Thai banks typically require applicants to provide proof of income, which can be a significant hurdle for many low-income individuals or those who work in the informal sector. This lack of access to formal credit has created a fertile ground for informal lending, which is often associated with high interest rates and predatory lending practices.

Many Thai people, particularly those living in rural areas, also face difficulty of access to credit due to the lack of infrastructure in these regions. With limited access to financial services, these individuals often have to rely on informal money lenders, who may charge exorbitant interest rates and exploit vulnerable borrowers.

In addition, the Thai government has implemented policies aimed at reducing household debt and limiting access to credit. While these policies may have positive effects in the long run, they also limit the options available to those who need credit to finance their daily lives or invest in their businesses.

Overall, the difficulty of access to credit in Thailand poses a significant challenge for many individuals and businesses, particularly those in low-income or rural communities. Without access to formal credit, these individuals may face significant financial challenges and be forced to rely on informal lending, which can lead to long-term debt and financial instability.

Despite the differences in credit systems, both the US and Thailand share a common goal: to provide financial stability and opportunities for their citizens. While Americans may have easier access to credit, they must also deal with the potential pitfalls of accumulating debt. Meanwhile, Thais must navigate the complex world of informal lending, where the risk of exploitation is high. Ultimately, it is up to each individual to make informed decisions about their financial well-being, regardless of the credit system in place.