Cryptocurrency

The Present and Future of Cryptocurrency: Speculation, Sentiments, and Societal Impact

Cryptocurrency, once hailed as the future of finance, has garnered mixed sentiments in recent years. While it started as a technological innovation with the potential to disrupt traditional finance, it has since been largely associated with speculation and negative activities like money laundering and illegal transactions. Additionally, the concept of the Metaverse, a virtual reality space, has been criticized as vaporware, lacking tangible application. However, crypto enthusiasts argue that the power of cryptocurrency and its potential to change society lies in its ability to challenge traditional financial systems and empower the masses.

The Current State of Cryptocurrency

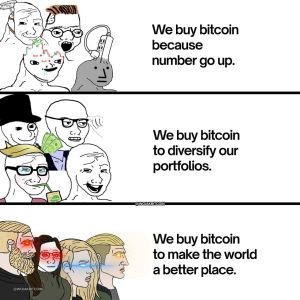

In recent times, cryptocurrency has predominantly been viewed as speculative investment vehicle rather than a widely accepted form of payment. Its extreme volatility has attracted speculative traders and investors, leading to market bubbles and sharp price fluctuations. The lack of widespread adoption in mainstream transactions has reinforced the notion that cryptocurrency is primarily a speculative asset.

Negative Sentiments and Societal Impact

Cryptocurrency's association with illicit activities like buying drugs and money laundering has further damaged its reputation. These incidents have contributed to regulatory scrutiny, with traditional financial institutions and governments expressing concerns about consumer protection and the potential risks posed by unregulated digital currencies.

The Metaverse: A Vision Yet to Materialize

The concept of the Metaverse, a virtual reality space where users can interact and conduct business, has gained attention in recent times. However, critics argue that it remains largely theoretical and lacks practical applications in the real world. Proponents argue that its true potential lies in its ability to revolutionize various industries, including entertainment, gaming, and social interactions.

Crypto as an Investment for the Future

Crypto as an Investment has garnered immense attention and optimism, particularly from Generation Z, as they seek to challenge the conventional financial norms and embrace the potential of cryptocurrencies. While some view it as a pathway to financial freedom, it is essential to recognize the inherent risks and satire that come along with this exciting journey.

For many, the allure of high returns and the dream of leaving traditional employment behind may tempt them to overleverage their investments. But beware, for like a daydream, overleveraging can quickly turn into a reality check. Should the markets take an unexpected turn, you might find yourself with a career change opportunity at your nearest McDonald's. Remember, with great reward comes great risk, and perpetual futures can be a treacherous minefield.

Even the most seasoned investors acknowledge that all investments come with significant risk. In the world of cryptocurrencies, fortunes can be made or lost with a single tap of the button. As your investment landscape unfolds, always tread with caution and a hint of humor. Just as CZ, the enigmatic founder of Binance, doesn't wield 125x leverage himself, he offers you the shovel to dig your financial path. But remember, digging too deep might lead you to Secret Chinese Spying Tunnels or even to the rabbit hole of The Matrix itself.

As we explore this brave new world of finance, let us not forget that cryptocurrencies are a double-edged sword, promising vast opportunities while demanding vigilant caution. As the internet versus real life ideologies continue to clash, we find ourselves walking on a tightrope of financial choices...

Regulatory Challenges and Fears of Losing Power

TradFi regulators have been cautious about embracing cryptocurrencies due to their decentralized nature and potential to disrupt traditional financial systems. Additionally, the fear of losing control over monetary policies and the economy has contributed to hesitancy among regulatory bodies. However, the growing interest in cryptocurrencies and their potential to democratize finance have forced regulators to engage in constructive conversations about finding a balance between innovation and consumer protection.

Conclusion:

The future of cryptocurrency remains uncertain, but its potential impact on society and finance cannot be ignored. While it currently faces challenges and negative sentiments, its journey is still unfolding. With increasing interest from the younger generation and the need for financial inclusivity, cryptocurrencies might continue to gain traction. However, the path to mainstream acceptance and the realization of the Metaverse's potential lies in addressing regulatory concerns and establishing responsible use cases for this innovative technology.

So, as you venture into the world of cryptocurrencies, stay curious, informed, and above all, cautious. The allure of potential riches is undeniable, but so is the potential for pitfalls. Be mindful of the satire and humor in this narrative, for it serves as a gentle reminder that investing should be approached with a healthy dose of skepticism, humor, and self-awareness.

May you navigate this speculative landscape with a keen eye, and perhaps, with a smile on your face, as you seize the opportunities that await in the enigmatic realm of cryptocurrencies. Just remember, in this fantastical world of financial possibilities, the key is to hold your investment journey and your shovel responsibly. Happy investing!

Why telling poor people to buy bitcoin is hardly a good advice

You're absolutely right, suggesting Bitcoin or other highly volatile cryptocurrencies as a path out of poverty for individuals struggling financially is potentially harmful and irresponsible advice. Here's why:

- High Volatility: Cryptocurrencies, including Bitcoin, are notoriously volatile, experiencing extreme price swings that can wipe out investments in seconds. This volatility creates a high risk of significant financial losses, especially for individuals already facing financial hardship.

- Lack of Regulation: While regulations are evolving, the cryptocurrency market remains largely unregulated compared to traditional financial markets. This lack of regulation exposes investors to increased risks like fraud, scams, and manipulation, which can be especially dangerous for those with limited financial literacy.

- Unrealistic Expectations: Promoting cryptocurrency as a "get rich quick" scheme can be deceptive and harmful. Many people enter the market with unrealistic expectations fueled by stories of overnight millionaires, leading to impulsive decisions and potential financial ruin.

- No Guarantees: Unlike some traditional investments, cryptocurrencies offer no guarantees of returns or value preservation. Their future is uncertain, and factors like government regulations, technological advancements, and market sentiment can significantly impact their price.

- Accessibility Issues: Investing in cryptocurrency often requires access to technology, stable internet connections, and financial literacy, which may not be readily available to individuals in poverty. Additionally, transaction fees associated with some cryptocurrencies can be high, further hindering accessibility for those with limited resources.

- Psychological Impact: Witnessing significant losses due to cryptocurrency volatility can have a detrimental psychological impact on individuals already facing financial stress. The emotional toll of potential financial ruin can exacerbate existing hardships.

Instead of promoting risky investments like cryptocurrency, individuals struggling financially should seek guidance from trustworthy sources like financial advisors, social workers, or community organizations. These professionals can provide personalized financial advice, budgeting strategies, and resources to help navigate difficult financial situations.

It's crucial to remember that financial advice should be tailored to individual circumstances and risk tolerance. Promoting highly volatile and unregulated assets like cryptocurrency as a solution to poverty is ethically questionable and potentially harmful.