Trader

Retard

They use the same words.

Navigating the Ups and Downs: Traders' Love-Hate Relationship with Charts

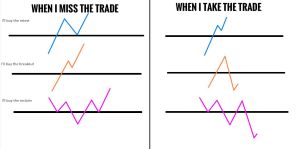

For traders, the world of financial markets is a rollercoaster ride of emotions. One moment, the charts are dancing to your tune, and the profits flow effortlessly. The next moment, a sudden turn of events leaves you scratching your head in disbelief. It's a love-hate relationship, a constant battle between triumph and defeat. However, there are ways to maintain this relationship and tilt the odds in your favor. Enter proper risk management and position sizing, the essential tools that can make or break a trader's success.

Embracing Risk Management:

Traders who have weathered the storm understand the paramount importance of risk management. The charts may appear enticing, but without a well-defined risk management strategy, you're navigating treacherous waters without a compass. Proper risk management involves setting stop-loss orders, defining risk-reward ratios, and adhering to disciplined trading plans. It acts as a safety net, ensuring that even when the charts turn against you, your losses are contained, and you live to trade another day.

The Art of Position Sizing:

Position sizing is the art of determining the appropriate amount of capital to allocate to each trade. It's the fine balance between preserving capital and maximizing returns. A trader's success is not solely measured by winning percentages but also by the size of their gains relative to their losses. By carefully selecting position sizes based on risk tolerance and market conditions, traders can optimize their returns and minimize the impact of potential losses.

Compounding Returns: A Path to Financial Freedom:

One of the most powerful concepts in investing is compounding returns. It's the magic that can turn small gains into substantial wealth over time. By reinvesting profits back into the market, traders can benefit from the compounding effect, where their initial investments grow exponentially. Imagine a scenario where your returns consistently outpace your interest charges on credit cards. With each successful trade, your capital increases, eventually paying off your debts and opening doors to financial freedom.

However, it's crucial to exercise caution and maintain a realistic perspective. While compounding returns can work wonders, it requires discipline, patience, and a long-term mindset. The journey may not always be smooth, and there will be bumps along the way. Traders must remember that managing risks, staying grounded, and continuously honing their skills are key components of a successful trading strategy.

Conclusion:

The relationship between traders and charts is an intricate dance of opportunity and challenge. It's a dynamic realm where success is never guaranteed, and losses can quickly overshadow gains. Yet, with proper risk management and position sizing, traders can navigate these unpredictable waters with greater confidence. And when combined with the power of compounding returns, the potential for long-term financial gains becomes even more enticing. So, embrace the charts, learn from their twists and turns, and let proper risk management and position sizing guide you towards a more prosperous trading journey.

Why forex trader are often underappreciated

The Underappreciated Art of Forex Trading

Forex trading, the act of buying and selling currencies in the global foreign exchange market, is a complex and dynamic field that often goes underappreciated. Despite its significance in the global economy and the potential for substantial financial gains, forex traders often find themselves undervalued and overlooked. In this article, we explore the reasons why forex traders are underappreciated and shed light on the skills and expertise they bring to the table.

Perception of Forex Trading:

Forex trading is often misunderstood or seen as a risky and speculative endeavor. This perception stems from misconceptions about the forex market being a realm of quick profits and high-risk gambling. In reality, successful forex trading requires extensive knowledge, skill, and disciplined decision-making. However, these aspects are often overshadowed by sensationalized stories or myths surrounding the industry.

Lack of Awareness:

Forex trading operates largely behind the scenes, away from the public eye. Unlike other financial professions, such as stockbrokers or investment bankers, forex traders work in a relatively invisible sector. This lack of visibility contributes to the underappreciation of their work and the skills they bring to the table. Many people are simply unaware of the complexities involved in forex trading and the role it plays in the global financial system.

Volatility and High-Stress Environment:

The forex market is known for its volatility and fast-paced nature. Traders constantly navigate fluctuating exchange rates, economic indicators, geopolitical events, and market sentiment. The ability to analyze, interpret data, and make split-second decisions is crucial. This high-stress environment can take a toll on traders, yet their ability to thrive under such pressure is often underappreciated.

Continuous Learning and Adaptability:

Forex trading requires continuous learning and adaptation to changing market conditions. Successful traders invest significant time and effort into understanding global economic trends, technical analysis, risk management strategies, and staying updated with market news. The constant need for education and skill enhancement is often overlooked by those who underestimate the depth of knowledge required to excel in forex trading.

Role in Global Economy:

Forex trading plays a vital role in facilitating international trade, managing currency risks, and maintaining liquidity in the global financial system. Traders help ensure that currencies are accurately valued and contribute to the stability of the international monetary system. However, the significance of this role is often underappreciated by the general public.

Conclusion:

Forex traders possess a unique set of skills, knowledge, and expertise that often go unnoticed or undervalued. Their ability to navigate the complexities of the forex market, make informed decisions, and contribute to the stability of the global financial system deserves recognition. By understanding the intricacies of forex trading and acknowledging the challenges faced by traders, we can gain a deeper appreciation for their contributions to the financial industry and the global economy.

Is trading better than Waging?

Trading Career: From 9-5 to 24/7 Workaholics

Are you tired of the monotonous grind of a 9-5 job? Do you yearn for the freedom and excitement of being your own boss? Well, look no further than the world of trading! Countless individuals have abandoned their stable jobs to embark on a thrilling journey of financial independence. But beware, for trading may not be the utopia you envision. In fact, many traders quickly realize that they've simply traded one set of chains for another.

Meet the brave souls who boldly quit their day jobs to become full-time traders. They believed they could escape the corporate rat race, only to find themselves entangled in the web of constant screen-watching, sleepless nights, and a never-ending battle against the ever-elusive profits. Yes, welcome to the world of 24/7 workaholics!

These traders, fueled by ambition and the dream of making it big, soon discover that the markets never sleep. While their colleagues are enjoying weekends and holidays, these traders are glued to their screens, analyzing charts, chasing trends, and battling the constant fear of missing out. Time off? Forget about it! Vacations become a distant memory as they grapple with the fear of a missed opportunity or a potential market crash.

But let's not forget the adrenaline rush! Nothing quite compares to the excitement of placing trades and seeing the numbers fluctuate before your eyes. It's a rollercoaster ride of emotions, with highs of jubilation and lows of despair. Who needs stable emotions, anyway? The constant surge of adrenaline is sure to keep your heart pounding and your stress levels at an all-time high.

And let's not overlook the glamorous lifestyle of the trader. Forget about lavish vacations or luxurious purchases; traders are known for their affinity for instant noodles and caffeine-fueled nights. The only thing they seem to accumulate is a mountain of empty coffee cups and an ever-expanding collection of trading books promising the secrets to untold riches.

So, if you're contemplating quitting your job to become a full-time trader, proceed with caution. Remember, trading is not just a job; it's a way of life. Be prepared to sacrifice your evenings, weekends, and even your sanity for the pursuit of profits. But hey, who needs sleep when you can have the thrill of staring at charts for hours on end?

In conclusion, trading may offer the allure of freedom and financial independence, but be prepared for the reality check. It's a world where 9-5 turns into 24/7, and stability gives way to constant uncertainty. So, before you make that leap, ask yourself: Is the grass truly greener on the trading side, or are you simply swapping one set of workaholic tendencies for another? The choice is yours, brave trader!

Trading Starts with You

Being a Trader Starts with You: The Journey of Self-Discovery in Forex

In the world of forex trading, every trader's journey is unique. The path to success is filled with ups and downs, but it all begins with one fundamental realization: being a trader starts with you.

Learning the Basics:

Many aspiring traders start with minimal knowledge. They might jump into the markets with ambitious goals but lack the foundational understanding. It's like trying to build a house without knowing how to lay the bricks. This phase can be overwhelming, and there's a temptation to look for shortcuts.

The Seduction of Indicators:

As you delve into the world of trading, the allure of indicators and trading strategies can be irresistible. You might start learning complex setups and trading systems without a solid grasp of market fundamentals. It's akin to learning to run before you can walk.

Failure and Self-Reflection:

Chasing indicators and complex strategies often leads to losses and a sense of frustration. In this phase, you may question your ability to succeed as a trader. It's a crucial moment for self-reflection, similar to a hero's journey in which they must confront their inner demons.

Changing Perspectives:

In trading, there's a turning point when you realize that the markets are ruthless. Mr. Market, the personification of the markets, doesn't care about your experience or knowledge. It operates solely on profits, trends, narratives, and sentiment. This realization alters your perspective on trading.

Accepting the Journey:

Trading, like any worthwhile endeavor, requires time and effort. It's a journey that can't be rushed or shortened. This acknowledgment is a significant step toward understanding that success won't come overnight. It echoes the ancient adage that Rome wasn't built in a day.

Gaining Wisdom:

As you continue your trading journey, you encounter both successes and failures. The experiences shape your wisdom and guide your decisions. The lessons learned from your mistakes often become invaluable.

The Mentor's Role:

Mentors, experienced traders like Mr. Pramoj, play a pivotal role. They bring wisdom and guidance to your journey. They can help you see the markets from a different perspective and provide insights that aren't found in textbooks.

Persistence and Dedication:

Ultimately, being a trader starts with a commitment to continuous learning. It's not about finding shortcuts but about developing your skills and understanding the nuances of the markets. With dedication and a willingness to endure challenges, you become a seasoned trader.

In the world of trading, there's no substitute for experience and hard work. Trading is a journey of self-discovery, where you'll face your inner demons, change perspectives, and gain wisdom along the way. Mr. Market doesn't discriminate; it's up to you to rise to the challenge and become the trader you aspire to be.