Shorts:Gambling with Titanic

The Titanic Wreck Exploration: A Gamble with Consequences

Once considered an unthinkable tragedy of the past, the exploration of the Titanic wreckage became an opportunity for the wealthy to witness history firsthand. OceanGate, a company at the forefront of underwater exploration, offered a chance to venture into the depths of the ocean, with each ticket costing a staggering $250,000. Excitement mingled with trepidation as the expedition's participants prepared to embark on a journey that would ultimately test their mettle.

OceanGate's engineers boasted a ship constructed from carbon fiber, a material believed to surpass the strength of steel. However, two concerned employees voiced safety concerns that went unheeded. Their warnings fell on deaf ears, and the company, driven by the allure of discovery and profit, proceeded with the expedition despite lingering doubts.

| 🎲 Content Disclaimer: Gambling | This wiki provides general information and does not endorse gambling, which can be subject to legal regulations. It is essential to conduct your research and understand local laws before participating. The information here is for educational purposes only and should not be considered legal or financial advice. Gambling involves risks, including potential financial loss, and should only be undertaken with discretionary funds. Visitors are encouraged to exercise caution, seek professional advice if needed, and adhere to responsible gambling practices. The wiki and its contributors are not liable for any consequences resulting from gambling decisions.Full Disclosures |

|---|

Amidst the unfolding spectacle, Welcome to the Late-Stage Capitalism, where there is a market for betting on the outcome of the exploration emerged—a degen play, as some would call it. People wagered on whether the wreckage of the submersible would be found, enticing even the most rational minds to indulge in a moment of recklessness. Among them was MoNoRi-Chan, swept up in the excitement and tempted by the allure of potential gains.

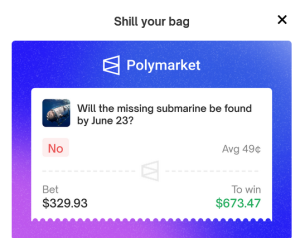

MoNoRi-Chan, overcome by the betting frenzy, Aped a daring $330 wager on the belief that the hull of the ship would not be discovered. Little did he know that the market's sentiment could shift in an instant, and the news of locating the debris of the submersible—though not the hull—sparked a dramatic reaction.

As the market reacted to the partial discovery, MoNoRi-Chan's fortunes took a nosedive. Riding a rollercoaster of emotions, his bet plummeted from -10% to a staggering -50%, with a crushing maximum drawdown of -80%. Yet, driven by unwavering determination and a willingness to embrace risk, he remained resolute, holding steadfast through the DD and back at -50% ROI.

The outcome of MoNoRi-Chan's audacious gamble remained uncertain, the final chapter of his story yet to be written. Tomorrow would bring the much-anticipated discussion that would determine the fate of his wager.

This tale offers a moral lesson—a stark reminder of the degen's relentless pursuit of excitement and the unpredictable consequences that follow. While MoNoRi-Chan's actions exemplify the risks and consequences of such a gamble, he also possesses the opportunity to pivot, to bet on the opposite outcome and reap profits, capitalizing on panic selling and market fluctuations.

As the discussion loomed, a new voice emerged amidst the chaos. It was !TheDon, a seasoned gambler who had witnessed the perils of degen plays before. He cautioned MoNoRi-Chan and Hagen about the risks they had taken, urging them to exercise patience and restraint. But the allure of potential gains proved too enticing, and they found themselves trapped in the turbulent currents of uncertainty.

In the aftermath, the outcome of their wagers remained uncertain, hanging precariously in the balance. Both MoNoRi-Chan and Hagen were now resigned to their fate, eagerly awaiting the resolution of their daring bets. The market's whims had taken control, and all they could do was watch, their emotions fluctuating with each twist and turn.

It was a lesson learned, a stark reminder that recklessness often begets volatility. The relentless pursuit of excitement and the urge to join the frenzy could lead to disastrous consequences. As !TheDon had warned, waiting for the price to settle down might have been the wiser choice, but in their impulsive state, they had succumbed to the temptations of the moment.

However, this story serves as a fictional account, a cautionary tale to remind readers that these actions should never be replicated in real life. The risks involved in degen plays are substantial, and the outcome is often uncertain, leaving those involved at the mercy of the ever-changing market.

So, as the final chapter of MoNoRi-Chan and Hagen's story remains unwritten, it is essential to remember that this is a work of fiction, designed to entertain and provoke thought. Real-world trading decisions should be based on careful analysis, prudent risk management, and a deep understanding of the market.

In the realm of fiction, we explore the boundaries of possibility, unraveling the complex human psyche. But when it comes to financial endeavors, it is crucial to approach with caution, relying on sound strategies and informed decision-making.

Let this tale serve as a reminder of the dangers of impulsive gambling, and may it inspire a renewed appreciation for the importance of prudence and responsibility in financial matters.

Disclaimer: This story is a work of fiction. The events, characters, and situations depicted are imaginary and should not be considered as advice or encouragement for real-life trading or gambling activities. Engaging in high-risk investments or speculative behaviors can lead to financial loss. Always conduct thorough research and consult with professionals before making any financial decisions.

Polymarket is not available for Residents of United States, please check your laws and regulations before Aping In.

Aftermath

Part 2: The Whale's Tale

The story of Titan Submersible wreckage surfaced back to the chat, even as the expedition to recover the submersible unfolded beneath the depths of the ocean. Amidst the ongoing drama, a subplot emerged—the role of crypto whales in determining the outcome of the bet.

As the submersible lay at the ocean's floor, crypto enthusiasts and gamblers worldwide had placed their bets on the outcome of its discovery. Many, including MoNoRi-Chan, had confidently wagered that the hull of the ship would remain undiscovered. But the situation took an unexpected turn when Polymarket, the platform hosting the bet, announced the resolution to be "Yes".

Confusion rippled through the betting community. How could a market that seemed clear in its sentiment—that the wreckage would never be found—resolve to the contrary? The answer lay in the complex mechanics of decentralized prediction markets, where when the dispute is raised, token holders had the power to sway the outcome.

In this case, UMA token holders held the key to the resolution. As whales within the UMA ecosystem, they possessed significant influence over the bet's outcome. Despite what appeared to be an overwhelming consensus against the discovery of the Titanic wreckage, these token holders voted in favor of a "Yes" resolution, leaving many bettors stunned.

MoNoRi-Chan, who had bet against the discovery, was among those left to grapple with the consequences of this unexpected turn of events. He watched helplessly as his wager, along with those of many others, was liquidated. The market's sentiment had been clear, but the mechanics of decentralized betting platforms had the final say.

The lesson learned here was twofold. First, it highlighted the inherent risks associated with decentralized prediction markets, where token holders could significantly influence outcomes. Second, it served as a stark reminder that in the world of crypto gambling, even when the odds seemed in your favor, unexpected factors could tilt the balance.

MoNoRi-Chan and his fellow gamblers had relied on the perceived clarity of the market sentiment, but they failed to account for the sway of whales and the intricacies of token-based governance. It was a costly lesson in the unpredictability of crypto betting platforms.

As the discussion continued among the bettors, a sense of disillusionment hung in the air. They had witnessed firsthand how market dynamics could be manipulated, and the consequences of such manipulation were starkly evident in the financial losses incurred.

In the end, the Titanic bet became a cautionary tale—a reminder that even in the decentralized world of crypto, where transparency and fairness are touted as virtues, unforeseen forces can shape the outcomes of bets, and whales may hold more power than one would expect. MoNoRi-Chan's $330 bet served as a stark example of how the seemingly clear-cut can turn tumultuous in the turbulent waters of the crypto gambling world.

So, as the Titanic sank once more, this time into the annals of crypto lore, the echoes of the bet and its unexpected resolution continued to reverberate throughout the crypto community, leaving many to ponder the unpredictable nature of the digital ocean they had chosen to navigate.