SL

SL (Stop Losses) is the Risk Management tool and a Bane of Traders' Existence

In the tumultuous world of forex trading, there exists a fiendish tool that haunts the dreams of traders everywhere - the notorious Stop Loss (SL). Traders, be warned, for this seemingly innocent risk management tool has an insidious secret lurking beneath its surface.

At first glance, the SL appears as a savior, promising to protect traders from catastrophic losses. It whispers sweet nothings of risk management and discipline, enticing traders to set their stop levels and sleep soundly at night. Little do they know the treacherous path they have embarked upon.

Stop Hunting

This article explains about stop hunting, the notorious practice that thrives in the shadows of the forex markets. It is said that if there were no stop hunting, there would be no market at all. The cunning market makers and institutional players, with their nefarious intentions, prowl the trading realm, seeking out the liquidity by sniping out hapless souls who dare to set their stop losses.

They lie in wait, watching the price dance ever so closely towards those carefully placed stop levels. And just when the trader's heart skips a beat in anticipation of an impending profit or loss, the market mysteriously veers in the opposite direction. The stop loss is triggered, and the trader is left dazed, confused, and penniless.

But wait, you might ask, isn't stop hunting a despicable practice? Shouldn't regulators be up in arms, fighting against this injustice? Ah, my dear reader, therein lies the twist. Stop hunting, some say, is the lifeblood of the forex market. It adds an element of excitement, a touch of danger, and a pinch of uncertainty to the trading game.

Without stop hunting, traders argue, the market would lose its charm, its allure. It is the adrenaline rush of being pursued by market predators that keeps traders on their toes. After all, what's life without a little thrill, a little risk?

So, traders, be prepared to dance with the devil as you set your stop losses. Embrace the possibility of being hunted, for it is in the midst of chaos that true traders are born. And remember, it's all part of the game. The markets giveth, and the markets taketh away, with or without stop losses.

In this treacherous world, where stop hunting and market manipulations prevail, the true masters of the game adapt and thrive. They combine risk management tools, market analysis, and a touch of intuition to navigate the perilous waters of forex trading.

So, dear traders, wear your stop losses like badges of honor, for they represent your courage in the face of uncertainty. Embrace the chase, for it is through the chaos that fortunes are made and legends are born. But most importantly, never forget that in this tumultuous world, knowledge, skill, and a hint of satire can be your ultimate weapons.

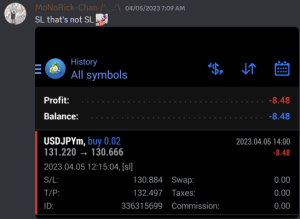

SL that's not SL

In MetaTrader 4 (MT4), the stop loss (SL) order is designed to protect traders by automatically closing a position at a predetermined price level to limit potential losses. However, there are scenarios where a trader can experience "slippage" or be "liquidated" past their intended stop loss level due to market volatility. This can happen for several reasons:

1. Market Gaps: During periods of high market volatility or news events, price gaps can occur. A price gap is when the price of a financial instrument jumps from one level to another without any trading activity in between. If the market gaps past the stop loss level, the order may be executed at the next available price, which could be worse than the intended stop loss level.

2. Order Execution Speed: The speed at which orders are executed can vary depending on market conditions and the broker's infrastructure. In fast-moving markets, the execution speed may be slower, leading to delays in executing the stop loss order. As a result, the market price can move significantly before the order is executed, potentially resulting in slippage beyond the stop loss level.

3. Market Liquidity: In highly illiquid markets or during times of low trading volume, it may be challenging to execute orders at specific price levels. This lack of liquidity can increase the likelihood of slippage, especially if there are limited buyers or sellers at the desired stop loss level.

It's important to note that slippage and the potential for liquidation past the stop loss level are inherent risks in trading, especially in volatile markets. Traders should carefully consider market conditions, volatility, and order execution speed when setting stop loss levels to minimize the risk of excessive slippage.

To mitigate the impact of slippage, traders can consider implementing additional risk management strategies such as using limit orders instead of market orders, utilizing advanced order types like trailing stops, or applying proper position sizing and risk management techniques to limit potential losses. Additionally, it's advisable to choose a reliable and reputable broker with robust execution capabilities and transparent order handling processes.

Disclaimer: This article is a work of satire and not meant to be taken literally. Stop losses are a widely used risk management tool in forex trading, and while stop hunting does occur in the markets, it is not the sole purpose or intention of market participants. Traders should always exercise caution, conduct thorough analysis, and use appropriate risk management techniques when trading.

Why you should always have an SL

MaiKC Learns the Hard Way: Why You Need a Stop-Loss (SL) in Forex

Yo traders, gather 'round! Let's talk about a harsh lesson learned by our boy MaiKC, fresh off a two-week forex grind that ended in nuked-account territory. Yep, you heard that right – wiped out. Why? Because MaiKC, like many before him, ignored the crucial advice of his sensei: use a stop-loss (SL)!

Now, MaiKC wasn't alone in his optimism. The market sentiment was 80% sell, charts looked like they were heading south, and everyone was predicting a drop. But here's the thing: the market is a fickle beast. Just when you think you've got it figured out, bam! It throws a curveball and sends your carefully crafted trade into the abyss.

That's where the magic of an SL comes in. Think of it like a safety net for your hard-earned baht. You set a price point where, if the market decides to do its crazy flip-flop, your position automatically closes, limiting your losses and keeping your account breathing.

Remember, even with the best analysis and market whispers, nothing is guaranteed. Don't be fooled by the siren song of "sure bets" – they don't exist in forex. That's why having an SL is like having a fire extinguisher in your trading kitchen. It might not prevent the occasional flare-up, but it sure beats watching your whole portfolio go up in flames.

Now, MaiKC is left with two choices:

- Top up his account with a measly 1000 baht, hoping for a quick comeback (risky business!).

- Start over next week, wiser and with a healthy dose of respect for the power of the SL.

Which path will he choose? Only time will tell. But one thing's for sure: MaiKC, and all of us traders, will never forget this valuable lesson.

So, remember, dear traders:

- Don't be a MaiKC. Use an SL every single time.

- Respect the market's unpredictability. No trade is guaranteed, so protect your capital.

- Learn from your mistakes (and MaiKC's!) and trade smarter, not harder.

Now go forth and conquer the forex markets, but always with a safety net in place! Remember, a small SL sting today is better than a full-blown account wipeout tomorrow. Trade safe, trade smart, and never forget the power of the SL!